Some Ideas on Property By Helander Llc You Need To Know

Some Ideas on Property By Helander Llc You Need To Know

Blog Article

Property By Helander Llc Can Be Fun For Anyone

Table of ContentsWhat Does Property By Helander Llc Mean?The 25-Second Trick For Property By Helander LlcThe Best Guide To Property By Helander LlcThe 9-Second Trick For Property By Helander LlcIndicators on Property By Helander Llc You Should KnowProperty By Helander Llc for Dummies

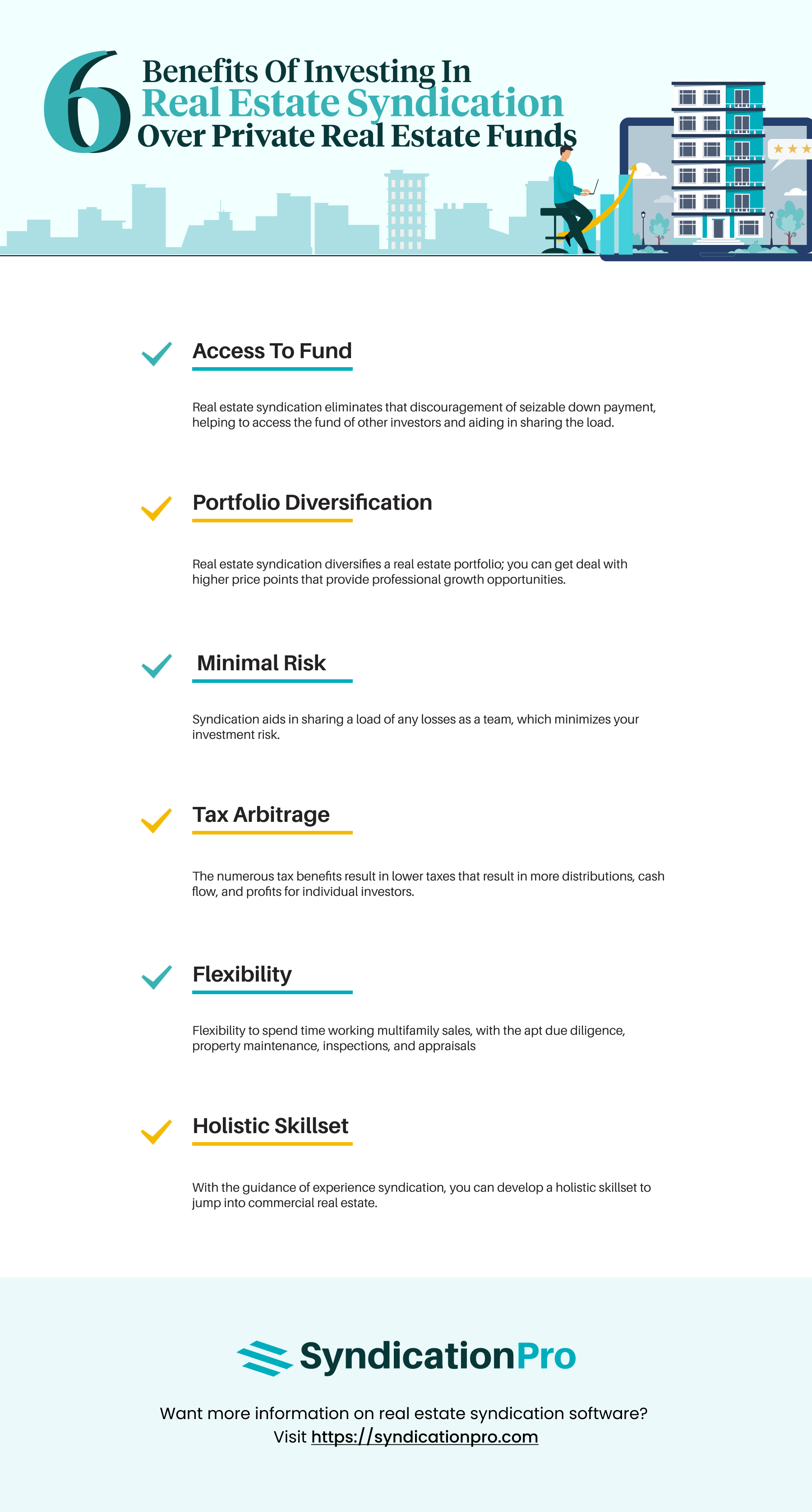

The benefits of investing in property are many. With appropriate assets, investors can enjoy foreseeable cash money circulation, excellent returns, tax obligation advantages, and diversificationand it's possible to utilize realty to develop wealth. Considering buying genuine estate? Right here's what you require to learn about realty benefits and why realty is considered a great investment.The benefits of spending in real estate include easy revenue, steady money flow, tax advantages, diversity, and take advantage of. Actual estate investment depends on (REITs) offer a way to invest in real estate without having to possess, run, or finance properties.

Oftentimes, cash flow only strengthens with time as you pay for your mortgageand accumulate your equity. Investor can take advantage of various tax breaks and reductions that can save cash at tax time. In general, you can deduct the affordable expenses of owning, operating, and taking care of a property.

The Property By Helander Llc Diaries

Real estate values have a tendency to raise gradually, and with an excellent investment, you can make a profit when it's time to market. Rents additionally have a tendency to increase over time, which can lead to greater money circulation. This graph from the Federal Reserve Bank of St. Louis reveals typical home costs in the united state

The locations shaded in grey indicate united state recessions. Mean List Prices of Residences Marketed for the USA. As you pay down a residential or commercial property home mortgage, you build equityan possession that belongs to your web worth. And as you build equity, you have the utilize to acquire even more buildings and enhance capital and wealth a lot more.

Since genuine estate is a substantial property and one that can serve as collateral, funding is easily offered. Genuine estate returns differ, depending on factors such as location, possession course, and management.

Property By Helander Llc Can Be Fun For Everyone

This, in turn, translates right into greater funding worths. Actual estate has a tendency to keep the buying power of funding by passing some of the inflationary stress on to occupants and by integrating some of the inflationary pressure in the kind of capital recognition - realtors in sandpoint idaho.

Indirect actual estate spending includes no direct possession of a residential or commercial property or buildings. Rather, you purchase a pool along with others, wherein an this website administration firm possesses and runs residential properties, otherwise possesses a profile of mortgages. There are a number of methods that owning property can safeguard versus inflation. First, home values may increase more than the price of inflation, bring about capital gains.

Ultimately, residential or commercial properties financed with a fixed-rate funding will see the family member amount of the month-to-month home mortgage repayments tip over time-- as an example $1,000 a month as a set repayment will certainly become much less difficult as rising cost of living wears down the acquiring power of that $1,000. Usually, a primary house is not taken into consideration to be a realty investment given that it is made use of as one's home

The Main Principles Of Property By Helander Llc

Despite the help of a broker, it can take a couple of weeks of work just to locate the right counterparty. Still, realty is a distinct property course that's basic to understand and can boost the risk-and-return profile of a financier's portfolio. On its own, property supplies cash circulation, tax breaks, equity building, affordable risk-adjusted returns, and a bush against inflation.

Spending in property can be an exceptionally satisfying and profitable endeavor, but if you're like a great deal of new capitalists, you might be questioning WHY you ought to be investing in property and what advantages it brings over other investment possibilities. Along with all the impressive benefits that go along with purchasing realty, there are some disadvantages you need to think about too.

Some Ideas on Property By Helander Llc You Need To Know

If you're searching for a method to purchase into the realty market without having to spend numerous hundreds of bucks, take a look at our properties. At BuyProperly, we use a fractional possession version that permits investors to start with as low as $2500. An additional major advantage of real estate investing is the ability to make a high return from acquiring, remodeling, and marketing (a.k.a.

The smart Trick of Property By Helander Llc That Nobody is Talking About

If you are charging $2,000 lease per month and you incurred $1,500 in tax-deductible expenses per month, you will only be paying tax obligation on that $500 profit per month (Sandpoint Idaho land for sale). That's a big difference from paying taxes on $2,000 each month. The earnings that you make on your rental device for the year is considered rental earnings and will be strained as necessary

Report this page